A small and messy market for Web3 marketers

What I’m about to say might sound like heresy to some, but it’s still true: Web3 is a small market. Even though it’s growing every year (especially during bull markets), its overall size is still tiny compared to more mature markets. Don’t believe me? Just check out the numbers below.

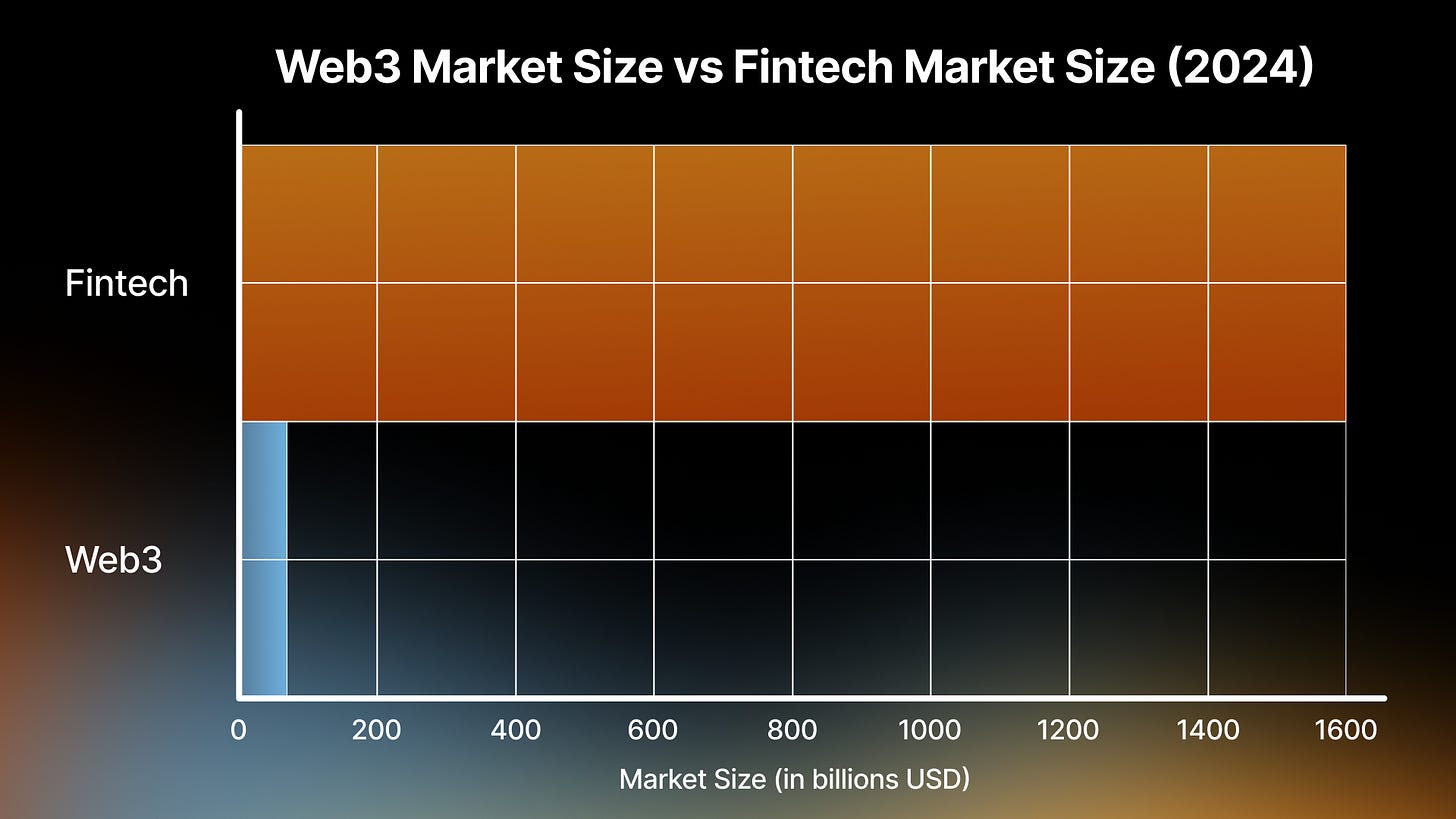

Here’s a comparison: the Web3 market is estimated at around $33 billion in 2024, while the Fintech market is a whopping $1.65 trillion. The graph makes the size difference pretty obvious.

It’s not a big pond. And if you break down the Web3 market into different customer segments, it gets even smaller—sometimes tiny. On top of that, it’s a messy market where reaching your actual audience is tough. You have to cut through layers of bots, token farmers, and scammers. All this makes targeting the right people in Web3 a challenge, one that requires new approaches to leverage decentralized networks and build audiences in ways that weren’t possible before.

Let’s dive deeper.

The problem with audiences and fake accounts in social networks

To understand my point, we need first to explain how audiences are built in Web3. Typically, Web3 marketers follow the same process as Web2 marketers: we define buyer personas, including their online behavior—channels they use, content they consume, influencers they follow, etc. With this clear picture, the next step is “simple”: we create a marketing plan to maximize the number of relevant touchpoints with your prospects until your brand is top of their mind. The image below explains how it works.

It looks straightforward, right? But here’s the catch that many don’t explain: bots, token farmers, and scammers. Using the regular Web2 audience building tools, it’s very hard to differentiate real accounts from simply bots (or accounts of real people that are heavily botted). Web3 is crawling with them, messing up public data and making it really hard to target the right people. Some estimates point to up to 20% of fake accounts on Twitter/X.

Based on our experience and the market sentiment, the problem is getting worse, and not only for crypto. This also drives up costs—you have to spend more to reach real users, hoping a decent percentage are genuinely interested. Conversion rates tank, and finding real users becomes a grind. It’s one of the biggest challenges for Web3 marketing today.

Building on the promising land of Web3 marketing

But here’s where Web3 has the potential to fix itself: on-chain data. By tapping into the blockchain, we can track audience behavior in ways that Web2 can’t. Just follow the tokens. Real users (aka real people trading and exchanging tokens) have distinct on-chain behaviors, unlike bots or farmers. By tracking these behaviors and identifying wallets that match real users, you can filter out the noise and reach the right people.

💡 Example: Let’s say your product offers a staking service for degens with attractive yields. You know this crowd is likely interested in similar services. In Web2, you’d target competitors’ audiences through social media, ads, or guerilla marketing, hoping that some of the users you are targeting are real people, and not simply junk accounts. However, you can also analyze on-chain data to identify wallets holding similar tokens, check their activity, and figure out which services they’re using. That way, you can spot real users and get valuable behavioral data that actually drives your marketing decisions.

Depending on your needs, you can fine-tune your analysis:

Looking for investors? Track wallets with significant funds.

Need users for similar services? Look at smart contract interactions.

Want to avoid burner wallets? Check wallet age.

The possibilities are huge, and we’re only just starting to understand how to use this data effectively.

Once you’ve got the data, how do you use it? That’s the tricky part. Wallet messaging isn’t a thing yet, and sending tokens or materials directly to wallets makes you look like a scammer. This is where creativity and technical skills come into play. At RZLT, we’ve been testing a few options, including the two below:

One approach is to reach users directly off-chain. Some on-chain tools can map wallets to social media accounts, letting you connect with people whose financial behavior matches your target audience.

Another option is Web3 ads. Some services allow you to send ads through dapps to specific wallets. These systems are still in their infancy but could deliver hyper-targeted marketing messages to precise audiences built using on-chain data.

Of course, there’s still work to do, and combining tools is a must. At RZLT, we’ve developed in-house tools alongside third-party services to build hypersegmented audiences using both on-chain and off-chain data. This helps us filter out bots, scammers, and farmers, delivering better results in terms of conversions, costs, and community growth—without the headache of dealing with fake accounts.

Sure, there are challenges—people use burner wallets and have multiple accounts—but using on-chain data to define your niche has become essential. In fact, we have the strong opinion that Web3 marketing, if we want to really make it work, should go into this direction. In the early 2000’s, cookies and pixels allowed marketers to track user behavior in new ways, and deliver marketing messages to hypersegmented audiences in a way that was not possible before Web2. For Web3, we can go a step further and use the on-chain data to do the same, but better. We are still taking the first steps to untap this opportunity.

If you're ready to cut through the noise and connect with your Web3 audience in a meaningful way, head over to our latest blog post! We’ve packed it with insights that can help sharpen your strategy, so you can start building the results you're looking for.